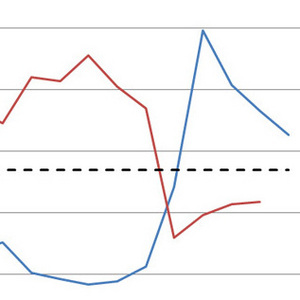

Corn, ethanol relationship reverse; E85 markets respond

October 10, 2013

BY Susanne Retka Schill

Advertisement

Advertisement

Related Stories

Representatives from the USGC, Growth Energy and the RFA recently conducted a strategic mission to Southeast Asia (SEA), underscoring the U.S. ethanol industry’s support for ethanol policy and technical advancement in Vietnam and the Philippines.

Production and use of renewable ethanol from ePURE members and other EU producers reduced greenhouse-gas emissions by an average of 79% compared to fossil fuels in 2024, according to newly certified data.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

U.S. fuel ethanol production was down nearly 3% the week ending June 20, according to data released by the U.S. Energy Information Administration on June 25. Stocks of fuel ethanol were up 1% and exports fell by 33%.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.