ADM reports improved ethanol performance in quarterly results

Archer Daniels Midland Co.

February 4, 2014

BY Erin Voegele

Advertisement

Advertisement

Related Stories

The Renewable Fuels Association on April 15 urged the USDA’s National Agricultural Statistics Service to reconsider its plan to stop reporting farm acreage, yield and production estimates at the county level.

The USDA increased its forecast for 2023-’24 corn use in ethanol production in its latest World Agricultural Supply and Demand Estimates report, released April 11. The agency also lowered its forecast for season-average corn prices.

The ethanol and ethanol co-product industry continues to be a main economic driver in Nebraska, producing near-historic averages in 2020, despite lower ethanol prices and COVID-related production issues, according to a new study.

Farmers Edge Inc. and Gevo Inc. will work with growers spanning three states to track and quantify the carbon intensity impact of climate-smart practices helping to accelerate the production of SAF and low-CI ethanol,

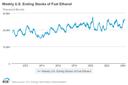

U.S. fuel ethanol production fell by nearly 2% the week ending April 5, according to data released by the U.S. Energy Information Administration on April 10. Ethanol stocks were down nearly 1% and exports expanded by 120%.