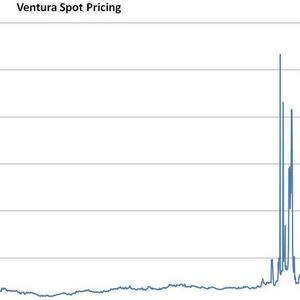

Commodities: Cold winter, other factors boost natural gas prices

March 28, 2014

BY Ben Straus, U.S. Energy Services

Advertisement

Advertisement

Related Stories

U.S. Trade Representative Katherine C. Tai on April 17 discussed efforts to increase market access for U.S. ethanol in Brazil during a hearing held by the Senate Committee on Finance focused on the Biden administration’s 2024 trade policy agenda.

A record volume of sugarcane was processed during Brazil’s recently completed 2023-’24 harvest season, according to UNICA, the Brazilian sugarcane industry association. Ethanol production also set a new record, with a significant boost from corn.

Following the success of a November 2023 program in Nigeria, the U.S. Grains Council (USGC) returned to the country in March to continue engagement with local stakeholders as the interest in E10 use in Nigeria’s fuel mix continues to grow.

The Renewable Fuels Association, U.S. Grains Council and Growth Energy in April jointly submitted comments within the Brazilian Chamber of Foreign Trade (CAMEX) regarding the Brazilian tariff on imported U.S. ethanol.

The U.S Energy Information Administration increased its forecast for 2024 fuel ethanol production in its latest Short-Term Energy Outlook, released April 9. The 2024 and 2025 forecasts for fuel ethanol blending were reduced.