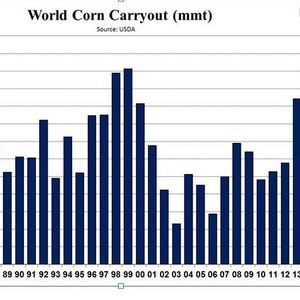

Commodities: USDA yield projections may be justified

September 29, 2015

BY Jason Sagebiel, FCStone

Advertisement

Advertisement

Related Stories

Indigo Ag and Red Trail Energy have announced a collaboration to source low carbon intensity (CI) corn to support farmers using sustainable practices and benefit from emerging clean fuels market tax credit programs.

U.S. Trade Representative Katherine C. Tai on April 17 discussed efforts to increase market access for U.S. ethanol in Brazil during a hearing held by the Senate Committee on Finance focused on the Biden administration’s 2024 trade policy agenda.

A record volume of sugarcane was processed during Brazil’s recently completed 2023-’24 harvest season, according to UNICA, the Brazilian sugarcane industry association. Ethanol production also set a new record, with a significant boost from corn.

Following the success of a November 2023 program in Nigeria, the U.S. Grains Council (USGC) returned to the country in March to continue engagement with local stakeholders as the interest in E10 use in Nigeria’s fuel mix continues to grow.

The Renewable Fuels Association on April 15 urged the USDA’s National Agricultural Statistics Service to reconsider its plan to stop reporting farm acreage, yield and production estimates at the county level.