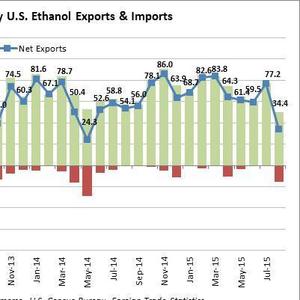

U.S. ethanol exports sank in August, DDGS shipments down slightly

SOURCE: RFA

October 7, 2015

BY Ann Lewis, RFA research analyst

Advertisement

Advertisement

Related Stories

To help ease the passage of U.S. agricultural products into Latin America (LTA), the U.S. Grains Council (USGC) recently held a workshop focused on port logistics and management in San Pedro Sula, Honduras.

Virgin Australia and Qatar Airways have agreed to work together with Renewable Developments Australia to become key partners on a project that will set out to deliver a homegrown SAF production facility in Australia.

The U.S. Energy Information Administration maintained its 2025 and 2026 forecasts for fuel ethanol production in its latest Short-Term Energy Outlook, released April 10. The agency also maintained its outlook for ethanol exports.

U.S. fuel ethanol production was down 4% the week ending April 4, according to data released by the U.S. Energy Information Administration on April 9. Stocks of fuel ethanol expanded by 2% and exports were up 180%.

Jet Zero Australia Pty Ltd has announced a FEED contract with Technip Energies and continuation of the owner’s engineering services contract with Long Energy & Resources for an ethanol-to-SAF project that will use LanzaJet technology.