Closed Doors, Open Windows

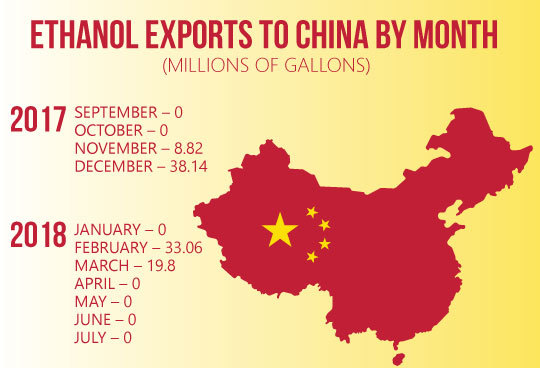

STATISTICS FROM US GRAINS COUNCIL

November 26, 2018

BY Lisa Gibson

Advertisement

Advertisement

Related Stories

Valero Energy Corp. on April 25 announced that its SAF project in Texas is progressing ahead of schedule and expected to be operational this year. The company also reported its ethanol and renewable diesel operations were profitable during Q1.

LanzaJet on April 22 announced an investment from Microsoft’s Climate Innovation Fund. This investment from Microsoft enables LanzaJet to continue building its capability and capacity to deploy its sustainable fuels process technology globally.

U.S. fuel ethanol production fell by 3% the week ending April 19, according to data released by the U.S. Energy Information Administration on April 24. Stocks of fuel ethanol were down 1% and exports fell by 23%.

Nebraska Gov. Jim Pillen on April 24 signed a legislative package that includes a tax credit to support the production of SAF within the state. The tax credit applies to eligible SAF that achieves at least a 50% GHG emissions reduction.

A coalition of 36 biofuel producers, ag groups, airlines and other SAF stakeholders on April 24 sent a letter to Agriculture Committee leaders in the House and Senate urging them to provide support for SAF in the upcoming Farm Bill.