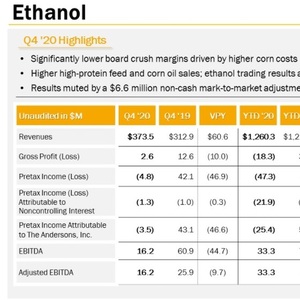

The Andersons: Ethanol segment performed well in Q4

February 17, 2021

BY Erin Krueger

Advertisement

Advertisement

Related Stories

A pan-European road trip featuring cars and trucks powered by renewable fuels logged 77,500 kilometers across 16 countries in a real-world demonstration that these fuels deliver significant GHG reductions.

International Air Transport Association has announced the release of the Sustainable Aviation Fuel (SAF) Matchmaker platform, to facilitate SAF procurement between airlines and SAF producers by matching requests for SAF supply with offers.

ATR and French SAF aggregator ATOBA Energy on June 19 signed a memorandum of understanding (MOU) to explore ways to facilitate and accelerate sustainable aviation fuel (SAF) adoption for ATR operators.

The USGC has added Sarah McLeeson as its new trade policy coordinator. McLeeson will organize staff and member travel, make arrangements for visiting trade teams and facilitate program planning and execution.

In June, the USGC held its third African Buyers and Sellers Conference in Abidjan, Ivory Coast, bringing together more than 95 attendees from across the continent to meet with U.S. feed grain suppliers and establish trade relationships.