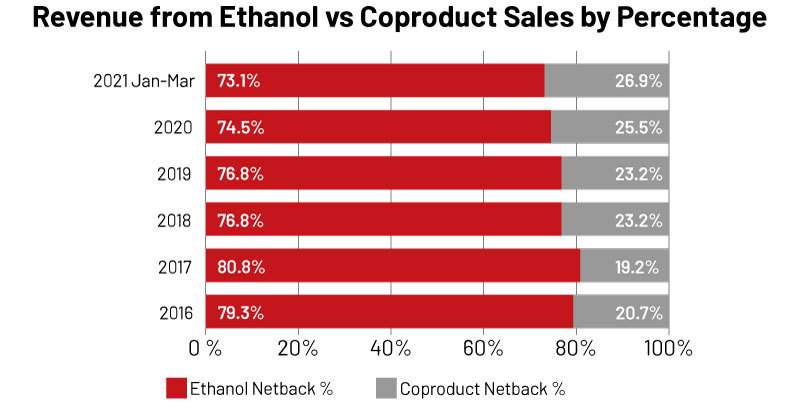

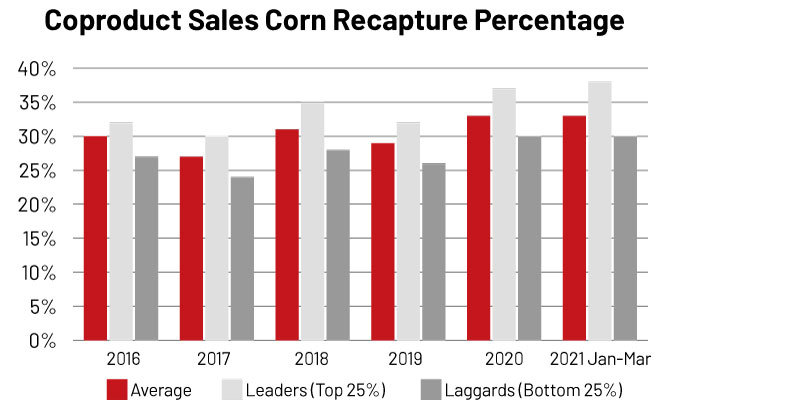

Coproducts Revenue Rising

PHOTO: STOCK

August 26, 2021

BY Holly Jessen

Advertisement

Advertisement

Related Stories

Fluid Quip Technologies: Adkins Energy to implement Overdrive system for enhanced oil yield and lower operating costs

Fluid Quip Technologies on April 24 announced that Adkins Energy will install FQT’s Overdrive Oil Pretreat System. This groundbreaking technology boosts the performance of existing distillers corn oil systems.

Green Plains Inc. on April 15 announced it is continuing the refreshment of its board of directors through appointments of three highly qualified and independent individuals: Steven Furcich, Carl Grassi, and Patrick Sweeney.

In April, the U.S. Grains Council and the National Corn Growers Association held trade policy academies in Ames, Iowa, and Birmingham, Michigan, for producers to learn about the latest developments affecting global markets for their goods.

Valero Energy Corp. released Q1 financial results on April 24, reporting that a tough margin environment negatively impacted the company’s renewable diesel operations during the three-month period. Valero’s ethanol segment was profitable.

UNICA, the Brazilian sugarcane industry association, has released final data for the 2024-’25 harvest season, reporting record high ethanol production and sales despite reduced sugarcane milling. Corn ethanol production was up significantly.