Canadian Producers Poised for Carbon Reduction Era

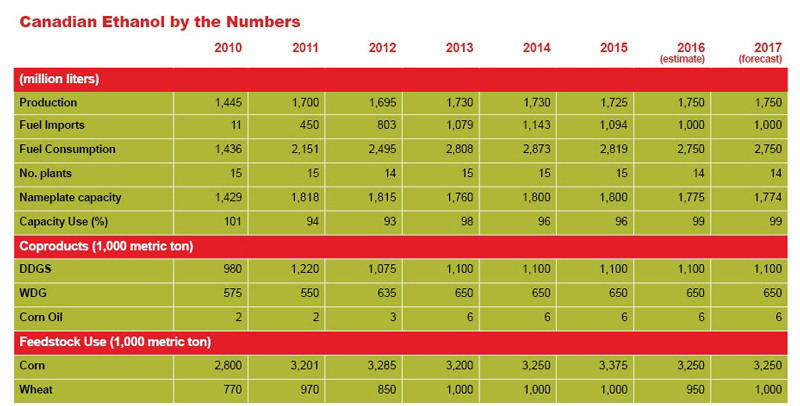

SOURCE: CANADA BIOFUELS ANNUAL 2016, USDA FAS GAIN REPORT ILLUSTRATION: BBI INTERNATIONAL

November 14, 2016

BY Susanne Retka Schill

Advertisement

Advertisement

Related Stories

Nearly 1.91 billion RINs were generated under the Renewable Fuel Standard in March, down from 1.92 billion generated during the same month of 2023, according to data released by the U.S. EPA on April 18.

The U.S. EPA on April 18 released updated small refinery exemption (SRE) data, reporting that two additional SRE petitions have been filed under the Renewable Fuel Standard in the past month. A total of 38 SRE petitions are now pending.

U.S. Trade Representative Katherine C. Tai on April 17 discussed efforts to increase market access for U.S. ethanol in Brazil during a hearing held by the Senate Committee on Finance focused on the Biden administration’s 2024 trade policy agenda.

Rep. Zach Nunn, R-Iowa, on April 17 introduced bipartisan legislation to implement year-round E15 sales. The Year-Round E15 Act would allow for sales of E15 in 2024 across eight Midwestern states.

U.S. fuel ethanol production was down 7% the week ending April 12, according to data released by the U.S. Energy Information Administration on April 17. Stocks of fuel ethanol were down slightly and exports expanded by more than 12%.