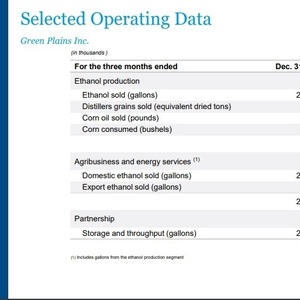

Green Plains reports Q4 loss, discusses plant improvements

February 21, 2022

BY Erin Krueger

Advertisement

Advertisement

Related Stories

International Sustainability & Carbon Certification has announced that Environment and Climate Change Canada has approved ISCC as a certification scheme in line with its sustainability criteria under its Clean Fuel Regulations.

Representatives from the USGC, Growth Energy and the RFA recently conducted a strategic mission to Southeast Asia (SEA), underscoring the U.S. ethanol industry’s support for ethanol policy and technical advancement in Vietnam and the Philippines.

Production and use of renewable ethanol from ePURE members and other EU producers reduced greenhouse-gas emissions by an average of 79% compared to fossil fuels in 2024, according to newly certified data.

Greene Tweed, a global leader in advanced materials and high-performance solutions, has released results from a study confirming the compatibility of its fluorine-based elastomer seals with sustainable aviation fuels (SAF).

The National Corn Growers Association is calling on entrepreneurs, researchers, and startups to reimagine the potential of field corn by entering the fifth round of the Consider Corn Challenge. Applications are due June 30.