Measuring Up Corn Fiber Ethanol

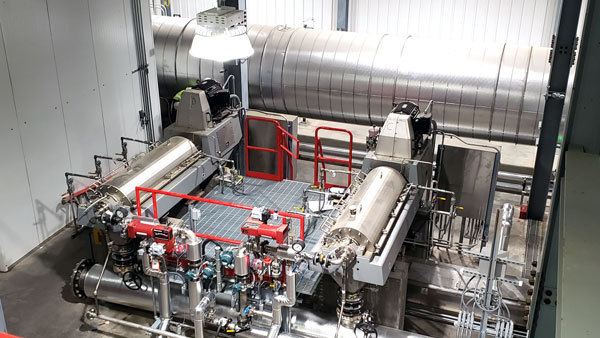

PHOTO: EDINIQ

September 17, 2022

BY Katie Schroeder

Advertisement

Advertisement

Related Stories

Production and use of renewable ethanol from ePURE members and other EU producers reduced greenhouse-gas emissions by an average of 79% compared to fossil fuels in 2024, according to newly certified data.

U.S. fuel ethanol production was down nearly 3% the week ending June 20, according to data released by the U.S. Energy Information Administration on June 25. Stocks of fuel ethanol were up 1% and exports fell by 33%.

The U.S. EPA on June 18 announced 1.75 billion RINs were generated under the RFS in May, down from 2.07 billion that were generated during the same period of last year. Total RIN generation for the first five months of 2025 reached 9.06 billion.

U.S. fuel ethanol production was down 1% the week ending June 13, according to data released by the U.S. Energy Information Administration on June 18. Stocks of fuel ethanol were up nearly 2% and exports were up 8%.

ALCO Energy Canada integrates Whitefox ICE to boost efficiency, increase production, and cut emissions

Whitefox Technologies has announced the successful installation of the Whitefox ICE membrane dehydration system at ALCO Energy Canada in Aylmer, Ontario. The project increased the facility’s production capacity by 13.5 MMgy.