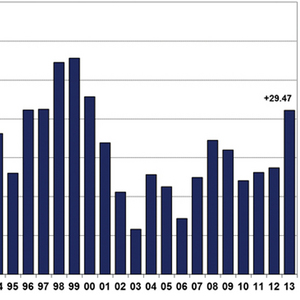

Corn market lackluster in November, but cash market strong

SOURCE: USDA/INTL FCStone

December 11, 2013

BY Jason Sagebiel, INTL FCStone Inc.

Advertisement

Advertisement

Related Stories

Leveraging a combined 200 years of experience, RCM - Thermal Kinetics’ engineers empower ethanol producers to improve energy efficiency.

The industry’s maintenance managers will come together later this summer to learn, network and troubleshoot shared challenges at the annual Team M3 Meeting.

Startup Nataqua hopes to help ethanol producers turn captured carbon dioxide into more on-site ethanol capacity.

A surge in corn kernel fiber as a feedstock is sweeping the industry, driven by incentives for low carbon intensities and EPA-approved testing methods for D3 RIN qualification.

The USDA currently predicts corn use in ethanol for the 2025-’26 marketing year to be unchanged when compared to the 2024-’25 marketing year, according to forecasts included in the agency’s latest WASDE report, released May 12.